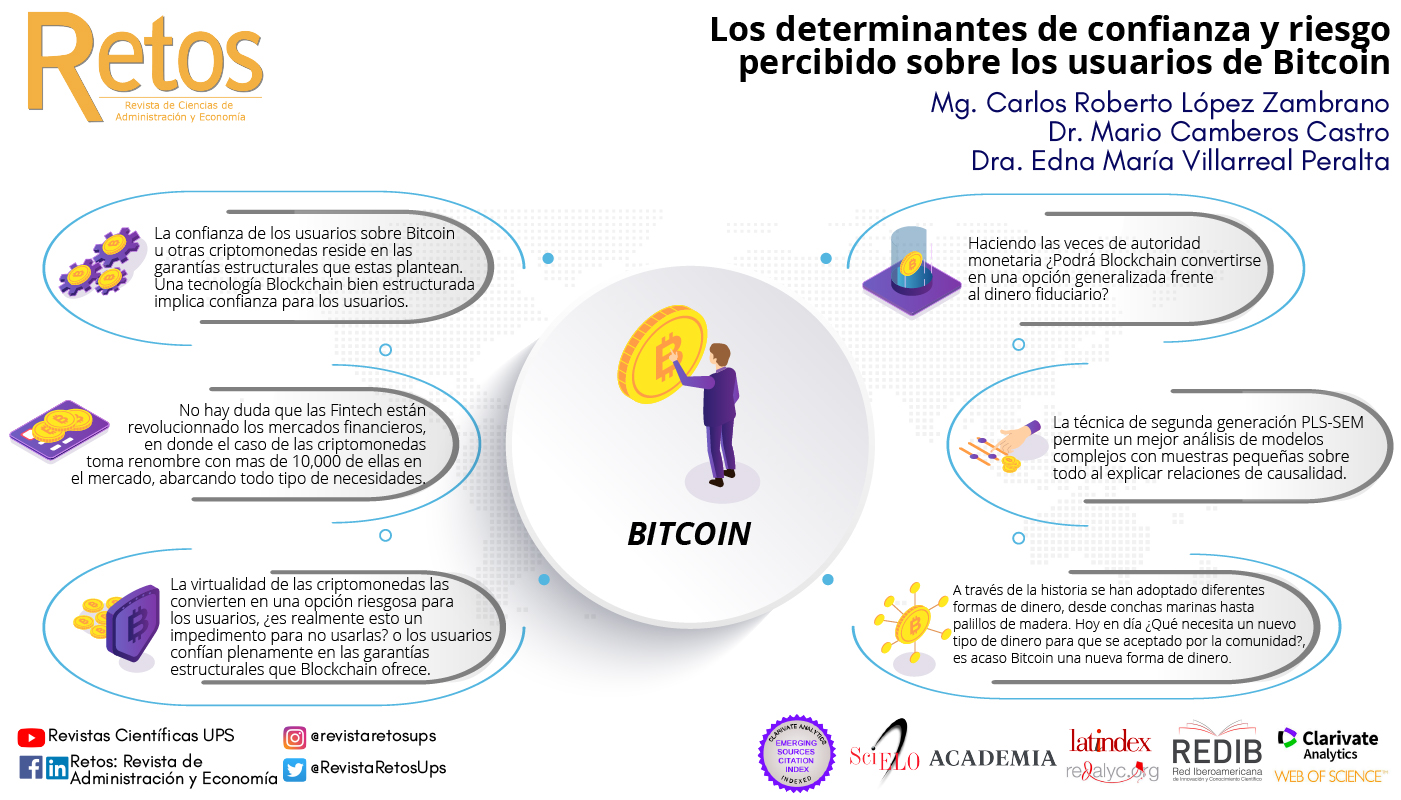

Los determinantes de confianza y riesgo percibido sobre los usuarios de bitcoin

Contenido principal del artículo

Resumen

Palabras Clave

Confianza, riesgo percibido, intención de uso, bitcoin, transacciones digitales, modelo PLS-SEM, garantías estructurales Trust, perceived risk, behavioral intention, bitcoin, digital transactions, PLS-SEM model, structural assurances

Descargas

Citas

Afshan, S., & Sharif, A. (2016). Acceptance of mobile banking framework in Pakistan. Telematics and Informatics, 33(2), 370–387. https://doi.org/10.1016/j.tele.2015.09.005

Alalwan, A. A., Dwivedi, Y. K., & Rana, N. P. (2017). Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. International Journal of Information Management, 37(3), 99–110. https://doi.org/10.1016/j.ijinfomgt.2017.01.002

Alalwan, A. A., Dwivedi, Y. K., Rana, N. P., & Algharabat, R. (2018). Examining factors influencing Jordanian customers’ intentions and adoption of internet banking: Extending UTAUT2 with risk. Journal of Retailing and Consumer Services, 40(August 2017), 125–138. https://doi.org/10.1016/j.jretconser.2017.08.026

Aljaafreh, A., Gill, A. Q., & Ani, A. Al. (2014). Towards the development of an initial trust model for the adoption of internet banking services in Jordan. Proceedings - Pacific Asia Conference on Information Systems, PACIS 2014, 1–12.

Blandin, A., Pieters, G. C., Wu, Y., Dek, A., Eisermann, T., Njoki, D., & Taylor, S. (2020). 3rd Global Cryptoasset Benchmarking Study. SSRN Electronic Journal, September. https://doi.org/10.2139/ssrn.3700822

Coinmarketcap. (2021). Cryptocurrency Market Capitalizations | CoinMarketCap. Coinmarketcap. https://coinmarketcap.com/

Esmaeilzadeh, P., Subramanian, H., & Cousins, K. (2019). Individuals’ cryptocurrency adoption: A proposed moderated-mediation model. 25th Americas Conference on Information Systems, AMCIS 2019, Saito 2015, 1–10.

Featherman, M. S., & Pavlou, P. A. (2003). Predicting e-services adoption: A perceived risk facets perspective. International Journal of Human Computer Studies, 59(4), 451–474. https://doi.org/10.1016/S1071-5819(03)00111-3

Gefen, D., Srinivasan Rao, V., & Tractinsky, N. (2003). The conceptualization of trust, risk and their electronic commerce: The need for clarifications. Proceedings of the 36th Annual Hawaii International Conference on System Sciences, HICSS 2003, 00(C), 1–10. https://doi.org/10.1109/HICSS.2003.1174442

Gefen, David. (2000). E-commerce: The role of familiarity and trust. Omega, 28(6), 725–737. https://doi.org/10.1016/S0305-0483(00)00021-9

Gefen, David, Karahanna, E., & Straub, Detmar, W. (2003). Trust and TAM in Online Shopping: An Integrated Model. MIS Quarter, 27(1), 51–90. https://doi.org/https://doi.org/10.2307/30036519

Gefen, David, & Straub, D. W. (2004). Consumer trust in B2C e-Commerce and the importance of social presence: Experiments in e-Products and e-Services. Omega, 32(6), 407–424. https://doi.org/10.1016/j.omega.2004.01.006

Gu, D., Khan, S., Khan, I. U., & Khan, S. U. (2019). Understanding mobile tourism shopping in Pakistan: An integrating framework of innovation diffusion theory and technology acceptance model. Mobile Information Systems, 2019. https://doi.org/10.1155/2019/1490617

Hair, J. F., Hult, G. T. M., Ringle, C. M., & Sarstedt, M. (2016). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). En Sage (2nd Editio). SAGE Publications, Ltd.

Hair, J. F., Sarstedt, M., Hopkins, L., & Kuppelwieser, V. G. (2014). Partial least squares structural equation modeling (PLS-SEM): An emerging tool in business research. European Business Review, 26(2), 106–121. https://doi.org/10.1108/EBR-10-2013-0128

Hair, J. F., Sarstedt, M., Ringle, C. M., & Mena, J. A. (2012). An assessment of the use of partial least squares structural equation modeling in marketing research. Journal of the Academy of Marketing Science, 40(3), 414–433. https://doi.org/10.1007/s11747-011-0261-6

Inoue, B. (2016). Performance of Bitcoin Protocol Variants [Nara Institute of Science and Technology]. https://library.naist.jp/mylimedio/dllimedio/showpdf2.cgi/DLPDFR012576_P1_83

Jr, J. F. H., Black, W. C., Babin, B. J., Anderson, R. E., Black, W. C., & Anderson, R. E. (2018). Multivariate Data Analysis. https://doi.org/10.1002/9781119409137.ch4

Kim, G., Shin, B., & Lee, H. G. (2009). Understanding dynamics between initial trust and usage intentions of mobile banking. Information Systems Journal, 19(3), 283–311. https://doi.org/10.1111/j.1365-2575.2007.00269.x

Kim, K. K., & Prabhakar, B. (2004). Initial Trust and the Adoption of B2C e-Commerce: The Case of Internet Banking. Data Base for Advances in Information Systems, 35(2), 50–64. https://doi.org/10.1145/1007965.1007970

Lee, M. C. (2009). Factors influencing the adoption of internet banking: An integration of TAM and TPB with perceived risk and perceived benefit. Electronic Commerce Research and Applications, 8(3), 130–141. https://doi.org/10.1016/j.elerap.2008.11.006

Leyva Cordero, O., & Olague, J. T. (2014). Modelo de Ecuaciones Estructurales por el método de mínimos cuadrados parciales (PLS). En Métodos Y Técnicas Cualitativas Y Cuantitativas Aplicables a La Investigación En Ciencias Sociales (Número April 2015, pp. 479–497).

López Zambrano, C. R., & Camberos Castro, M. (2020). Aceptación y confianza de Bitcoin en México: una investigación empírica. Entre ciencia e ingeniería, 14(28), 16–25. https://doi.org/10.31908/19098367.2011

Mahomed, N. (2017). Understanding consumer adoption of cryptocurrencies. En Master Thesis, Gordon Insititute of Business Science, University of Pretoria. (Número November). https://repository.up.ac.za/handle/2263/64874

Mayer, R. C., Davis, J. H., & Schoorman, F. D. (1995). An Integrative Model of Organizational Trust. The Academy of Management Review, 20(3), 709–734. https://doi.org/https://doi.org/10.2307/258792

Mensah, I. K., Chuanyong, L., & Zeng, G. (2020). Factors determining the continued intention to use mobile money transfer services (MMTS) among university students in Ghana. International Journal of Mobile Human Computer Interaction, 12(1), 1–21. https://doi.org/10.4018/IJMHCI.2020010101

Min, S., So, K. K. F., & Jeong, M. (2018). Consumer adoption of the Uber mobile application: Insights from diffusion of innovation theory and technology acceptance model. Journal of Travel and Tourism Marketing, 00(00), 1–14. https://doi.org/10.1080/10548408.2018.1507866

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic cash system, [Online] Available: https://bitcoin.org/bitcoin.pdf. En Pdf [Accessed 27 Aug. 2018]. http://bitcoin.org/bitcoin.pdf

Oliveira, T., Faria, M., Thomas, M. A., & Popovi?, A. (2014). Extending the understanding of mobile banking adoption: When UTAUT meets TTF and ITM. International Journal of Information Management, 34(5), 689–703. https://doi.org/10.1016/j.ijinfomgt.2014.06.004

Oliveira, T., Thomas, M., Baptista, G., & Campos, F. (2016). Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Computers in Human Behavior, 61(2016), 404–414. https://doi.org/10.1016/j.chb.2016.03.030

Owusu Kwateng, K., Osei Atiemo, K. A., & Appiah, C. (2019). Acceptance and use of mobile banking: an application of UTAUT2. Journal of Enterprise Information Management, 32(1), 118–151. https://doi.org/10.1108/JEIM-03-2018-0055

Pavlou, P. A. (2003). Consumer acceptance of electronic commerce: Integrating trust and risk with the technology acceptance model. International Journal of Electronic Commerce, 7(3), 101–134. https://doi.org/10.1080/10864415.2003.11044275

Roos, C. (2015). The motivation and factors driving crypto-currency adoption in SMEs. En Master Thesis, Gordon Insitute of Business Science, University of Pretoria (Número Noviembre). University of Pretoria.

Sadhya, V., Sadhya, H., Hirschheim, R., & Watson, E. (2018). Exploring technology trust in Bitcoin: The blockchain exemplar. 26th European Conference on Information Systems: Beyond Digitization - Facets of Socio-Technical Change, ECIS 2018, 1–16.

Sas, C., & Khairuddin, I. E. (2015). Exploring Trust in Bitcoin Technology. December, 338–342. https://doi.org/10.1145/2838739.2838821

Shahzad, F., Xiu, G. Y., Wang, J., & Shahbaz, M. (2018). An empirical investigation on the adoption of cryptocurrencies among the people of mainland China. Technology in Society, 55(May), 33–40. https://doi.org/10.1016/j.techsoc.2018.05.006

Sun, B., Sun, C., Liu, C., & Gui, C. (2017). Research on Initial Trust Model of Mobile Banking Users. Journal of Risk Analysis and Crisis Response, 7(1), 13. https://doi.org/10.2991/jrarc.2017.7.1.2

Venkatesh, V., Thong, J. Y. L., & Xu, X. (2012). Consumer Acceptance and Use of Information Technology: Extending the Unified Theory of Acceptance and Use of Technology. MIS Quarterly, 36(1), 157–178. https://doi.org/https://doi.org/10.2307/41410412

Vinzi, V. E., Chin, W. W., Henseler, J., & Wang, H. (2010). Handbook of Partial Least Squares Concepts. En Handbook of Statistical Bioinformatics. https://doi.org/10.1007/978-3-642-16345-6

Xie, Q., Song, W., Peng, X., & Shabbir, M. (2017). Predictors for e-government adoption: Integrating TAM, TPB, trust and perceived risk. Electronic Library, 35(1), 2–20. https://doi.org/10.1108/EL-08-2015-0141

Yeong, Y. C., Kalid, K. S., & Sugathan, S. K. (2019). Cryptocurrency acceptance: A case of Malaysia. International Journal of Engineering and Advanced Technology, 8(5), 28–38. https://doi.org/10.35940/ijeat.E1004.0585C19

Zhou, T. (2012). Examining mobile banking user adoption from the perspectives of trust and flow experience. Information Technology and Management, 13(1), 27–37. https://doi.org/10.1007/s10799-011-0111-8

Zhou, T., Lu, Y., & Wang, B. (2010). Integrating TTF and UTAUT to explain mobile banking user adoption. Computers in Human Behavior, 26(4), 760–767. https://doi.org/10.1016/j.chb.2010.01.013