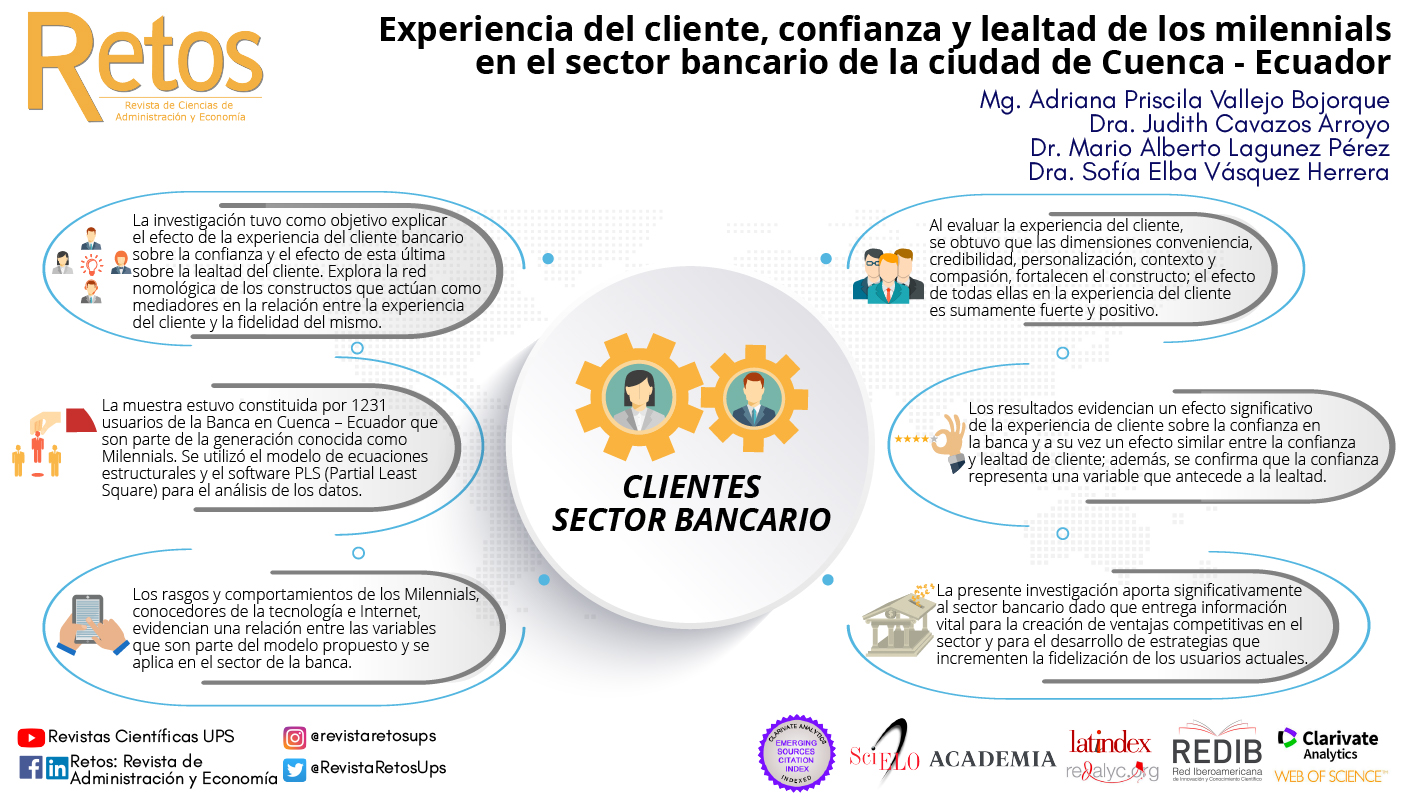

Experiencia del cliente, confianza y lealtad de los millennials en el sector bancario de la ciudad de Cuenca-Ecuador

Contenido principal del artículo

Resumen

Detalles del artículo

Autoría: La lista de autores firmantes debe incluir únicamente a aquellas personas que hayan contribuido intelectualmente al desarrollo del trabajo. La colaboración en la recogida de datos no es, por sí misma, criterio suficiente de autoría. "Retos" declina toda responsabilidad por posibles conflictos derivados de la autoría de los trabajos que se publiquen.

Derechos de autor: La Universidad Politécnica Salesiana preserva los derechos de autor de los artículos publicados, y favorece y permite su reutilización bajo la licencia Creative Commons Attribution-NonCommercial-ShareAlike 3.0 Ecuador. Pueden ser copiados, utilizados, difundidos, transmitidos y expuestos públicamente, siempre y cuando: i) se cite la autoría y la fuente original de su publicación (revista, editorial y URL del trabajo); (Ii) no se utilicen con fines comerciales; Iii) se mencione la existencia y especificaciones de esta licencia.

Referencias

Arora, S., & Sandhu, S. (2018). Usage based upon reasons: the case of electronic banking services in India. International Journal of Bank Marketing, 36(4), 680-700. doi: https://doi.org/10.1108/IJBM-03-2017-0060

Bhattacherjee, A. (2002). Individual trust in online firm: scale development initial test. Journal of Management Information Systems 19 (1): 211-241. doi: https://doi.org/10.1080/07421222.2002.11045715

Bagozzi, R. P., Yi, Y., & Phillips, L. W. (1991). Assessing Construct Validity in Organizational Research. Administrative Science Quarterly, 36(3), 421. doi: https://doi.org/10.2307/2393203

Bashir, I., & Madhavaiah, C. (2015). Consumer attitude and behavioural intention towards Internet banking adoption in India. Journal of Indian Business Researc, 7(1), 67 - 102. doi: https://doi.org/10.1108/jibr-02-2014-0013

Brakus, J. J., Schmitt, B. H., & Zarantonello, L. (2009). Brand Experience: What is It? How is it Measured? Does it Affect Loyalty? Journal of Marketing, 73(3), 52–68. doi: https://doi.org/10.1509/jmkg.73.3.052

Buttle, Francis. (2008). Customer relationship management: concepts and technologies. doi: https://doi.org/10.4324/9780080949611

Chin, W. (1998). The partial least square approach to structural equation modelling. En G. Marcoulides (Ed.), Modern Methods for Business Research. Mahawah, Estados Unidos: Lawrence Erlbaum, pp. 295-369.

Chin, W.W. How to write up and report PLS analyses. In Handbook of Partial Least Squares: Concepts, Methods and Application; Esposito, V.V., Chin, W., Henseler, J., Wang, H., Eds.; Springer: New York, NY, USA, 2010; pp. 645–689.

De Keyser, A. (2015). Understanding and managing the customer experience. PhD Series Ghent University. Faculty of Economics and Business Administration. Ghent University. Faculty of Economics and Business Administration, Ghent, Belgium.

Dabholkar, P., & Overby, J. (2005). Linking process and outcome to service quality and customer satisfaction evaluations: an investigation of real estate agent service. International Journal of Service Industry Management,, 16(1), 10–27. doi: https://doi.org/10.1108/09564230510587131

Doney, P., & Cannon, J. (1997). An examination of the nature of trust in buyer-seller. Journal of Marketing, 35–51. doi: https://doi.org/10.1177/002224299706100203

Drig?, I., & Isac, C. (2014). E-banking services-features, challenges and benefits. Annals of the University of Petro?ani Economics, 14(1), 41 - 50.

Fornell, C.; Larcker, D.F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 18 (1), 39–50. doi: https://doi.org/10.2307/3151312

Geisser, S. (1974). A predictive approach to the random effects model. Biometrika, 61, 101-107. doi: https://doi.org/10.1093/biomet/61.1.101

Gillani, S. U. A., & Awan, Dr. A. G. (2014). Customer Loyalty in Financial Sector: A case study of Commercial Banks in Southern Punjab. International Journal of Accounting and Financial Reporting, 1(1), 587. doi: https://doi.org/10.5296/ijafr.v4i2.6870

INEC. (2019). Instituto Nacional de Estadisticas y Censos. Retrieved from https://www.ecuadorencifras.gob.ec/institucional/home/

Jarvenpaa, S., Tractinsky, N., & Vitale, M. (2000). Consumer trust in an Internet store. INFORMATION TECHNOLOGY AND MANAGEMENT, 1(1/2), 45–71. https://doi.org/10.1023/A:1019104520776

Kamath, P. R., Pai, Y. P., y Prabhu, N. K. P. (2019). Building customer loyalty in retail banking: a serial-mediation approach. International Journal of Bank Marketing. doi: https://doi.org/10.1108/IJBM-01-2019-0034

Kaur, S., & Arora, S. (2020). Role of perceived risk in online banking and its impact on behavioral intention: trust as a moderator. Journal of Asia Business Studies. doi: https://doi.org/10.1108/JABS-08-2019-0252

Kavitha, S., & Haritha, P. (2018). A Study on Customer Experience and its Relationship with Repurchase Intention among Telecom Subscribers in Coimbatore District. International Journal of Management Studies, V(3(3)), 83. doi: https://doi.org/10.18843/ijms/v5i3(3)/11

Lancaster, L. and Stillman, D. (2002), When Generations Collide, HarperCollins Publishing, New York, NY.

Leguina, A. (2015) A primer on partial least squares structural equation modeling (PLS-SEM), International Journal of Research & Method in Education, 38:2, 220-221, doi: https://doi.org/10.1080/1743727X.2015.1005806

Leninkumar, V. (2017). The Relationship between Customer Satisfaction and Customer Trust on Customer Loyalty. International Journal of Academic Research in Business and Social Sciences, 7(4). doi: https://doi.org/10.6007/ijarbss/v7-i4/2821

Loureiro, Sandra & Miranda, F. Javier & Breazeale, Michael. (2014). Who Needs Delight? The Greater Impact of Value, Trust and Satisfaction in Utilitarian, Frequent-Use Retail. Journal of Service Management. 25. doi: https://doi.org/10.1108/josm-06-2012-0106

Mbama, C. I., Ezepue, P., Alboul, L., & Beer, M. (2018). Digital banking, customer experience and financial performance: UK bank managers’ perceptions. Journal of Research in Interactive Marketing, 12(4), 432–451. doi: https://doi.org/10.1108/JRIM-01-2018-0026

Micu, A. E., Bouzaabia, O., Bouzaabia, R., Micu, A., & Capatina, A. (2019). Online customer experience in e-retailing: implications for web entrepreneurship. International Entrepreneurship and Management Journal, 15(2), 651–675. doi: https://doi.org/10.1007/s11365-019-00564-x

Moliner-Tena, M. A., Monferrer-Tirado, D., & Estrada-Guillén, M. (2019). Customer engagement, non-transactional behaviors and experience in services: A study in the bank sector. International Journal of Bank Marketing, 37(3), 730–754. doi: https://doi.org/10.1108/IJBM-04-2018-0107

Nowak, L., Thach, L., & Olsen, J. E. (2006). Wowing the millennials: Creating brand equity in the wine industry. Journal of Product and Brand Management, 15(5), 316–323. doi: https://doi.org/10.1108/10610420610685712

Omoregie, O. K., Addae, J. A., Coffie, S., Ampong, G. O. A., & Ofori, K. S. (2019). Factors influencing consumer loyalty: evidence from the Ghanaian retail banking industry. International Journal of Bank Marketing, 37(3), 798–820. doi: https://doi.org/10.1108/IJBM-04-2018-0099

Partridge, H., & Hallam, G. (2006). Educating the Millennial Generation for evidence based information practice. Library Hi Tech, 24(3), 400–419. doi: https://doi.org/10.1108/07378830610692163

Pavlou, P.A. (2003). Consumer Intentions to Adopt Electronic Commerce–Incorporating Trust and Risk in the Technology Acceptance Model, International Journal of Electronic Commerce 7 (3): 101-123. doi: https://doi.org/10.1080/10864415.2003.11044275

Pikkarainen, K., Pikkarainen, T., Karjaluoto, H., & Pahnila, S. (2006). The measurement of end-user computing satisfaction of online banking services: empirical evidence from Finland. International Journal of Bank Marketing,, 24(3), 158-172. doi: https://doi.org/10.1108/02652320610659012

Roy, M., O. Dewit y B. Aubert (2001). The impact of interface usability on trust in web retailers. Internet Research: Electronic Networking Applications and Policy 11 (5): 388-398. doi: https://doi.org/10.1108/10662240110410165

Sáenz, K., & Tamez, G. (2014). Modelo de ecuaciones estructurales por el método de mínimos cuadrados parciales. In Métodos y Técnicas Cualitativas y Cuantitativas Aplicables a la Investigación en Ciencias Sociales. Tirant Humanidades.

Safeena, R., Date, H., Hundewale, N., & Kammani, A. (2013). Combination of TAM and TPB in electronic banking adoption. International Journal of Computer Theory and Engineering, 5(1), 146. doi: https://doi.org/10.7763/ijcte.2013.v5.665

San Martín, S. y Camarero, C. (2010): "Los determinantes de la confianza del comprador online. Comparación con el caso subasta", Cuadernos de Gestión, Vol 10, nº especial, pp.43-61, doi: https://doi.org/10.5295/cdg.100187ss

Sarin, S., Sego, T., & Chanvarasuth, N. (2003). Strategic use of bundling for reducing consumers’ perceived risk associated with the purchase of new high-tech products. Journal of Marketing Theory and Practice, 71 - 83. doi: https://doi.org/10.1080/10696679.2003.11658502

Shamsuddoha, Mohammad and Alamgir, Mohammed, Loyalty and Satisfaction Construct in Retail Banking - An Empirical Study on Bank Customers (July 4, 2003). The Chittagong University Journal of Business Administration, Vol. 19, 2004, Available at SSRN: doi: https://ssrn.com/abstract=1295427

Slåtten, T., Krogh, C., & Connolley, S. (2011). Make it memorable: customer experiences in winter amusement parks. International Journal of Culture, Tourism and Hospitality Research, 5(1), 80–91. doi: https://doi.org/10.1108/17506181111111780

Srivastava, M., & Kaul, D. (2016). Exploring the link between customer experience–loyalty–consumer spend. Journal of Retailing and Consumer Services, 31, 277–286. doi: https://doi.org/10.1016/j.jretconser.2016.04.009

Stone, M. (1974). Cross-validatory choice and assessment of statistical predictions. Journal of the Royal Statistical Society, 36, 111-147. doi: https://doi.org/10.1111/j.2517-6161.1976.tb01573.x

Suh, B. e I. Han (2002). Effect of trust on customer acceptance of Internet banking. Electronic Commerce Research and Applications 1 (3/4): 247-263. doi: https://doi.org/10.1016/s1567-4223(02)00017-0

Torres, Eduardo; Manzur, Enrique; Olavarrieta, Sergio y Barra, Cristóbal. Análisis de la relación confianza-compromiso en la banca en internet. Revista Venezolana de Gerencia [online]. 2009, vol.14, n.47, pp. 371-392. ISSN 1315-9984. doi: https://doi.org/10.31876/revista.v14i47.10539

Verhoef, P. C., Lemon, K. N., Parasuraman, A., Roggeveen, A., Tsiros, M., & Schlesinger, L. A. (2009). Customer Experience Creation: Determinants, Dynamics and Management Strategies. Journal of Retailing, 85(1), 31–41. doi: https://doi.org/10.1016/j.jretai.2008.11.001

Wasan, P. (2018). Predicting customer experience and discretionary behaviors of bank customers in India. International Journal of Bank Marketing, 36(4), 701–725. doi: https://doi.org/10.1108/ijbm-06-2017-0121